VF555 giúp cho bet thủ có được nguồn lợi nhuận cực khủng và thỏa mãn niềm đam mê giải trí trọn vẹn từng phút từng giây. Vậy cá cược tại VF555 có uy tín không? Sản phẩm nào đáng để trải nghiệm? Mời bạn đọc ghé đến bài viết bên dưới để được phổ cập thông tin chi tiết về nhà cái!

VF555 là nhà cái trực tuyến đứng đầu tại thị trường Việt Nam nói riêng cũng như châu Á nói chung. Địa chỉ thu hút đông đảo thành viên tham gia nhờ duy trì được chất lượng sản phẩm, cam kết uy tín và dịch vụ chăm sóc tận tâm. Được thành lập vào năm 2015, VF555 nhanh chóng trở thành cái tên được nhắc đến ở mọi diễn đàn trực tuyến, tiếp cận hàng triệu dân chơi.

Khi tham gia VF555, bạn sẽ không lo thiếu hình thức cá cược khi địa chỉ có đến 10000 phiên bản game khác nhau, trải dài ở nhiều thể loại như slot, game bài, xổ số. Nhà cái này cam kết mang đến môi trường giải trí đạt tiêu chuẩn công bằng, minh bạch và rõ ràng tuyệt đối. Người chơi sẽ được công bố tường tận những điều khoản, điều kiện quan trọng để đảm bảo thực hiện đúng nghĩa vụ.

Bên cạnh đó, VF555 còn gây ấn tượng mạnh với giao diện website hiện đại, thân thiện và tối ưu trên cả hai nền tảng điện thoại, máy tính. Với giấy phép hoạt động hợp pháp và thương vụ hợp tác cùng nhiều nhà cung cấp game hàng đầu, VF555 đảm bảo xây dựng kho tàng cá cược chất lượng cao, đãi ngộ khủng.

VF555 tạo ra những phút giây thăng hoa cho các bet thủ nhờ cung cấp nền tảng có rất nhiều điểm đặc sắc dưới đây:

VF555 cung cấp vô vàn trò chơi hấp dẫn bao gồm cá cược thể thao, casino trực tuyến, bắn cá, xổ số và nổ hũ, với chất lượng cực cao. Sự phong phú của danh sách cộng hưởng với đồ họa đẹp mắt, tích hợp công nghệ hiện đại, bet thủ có thể dễ dàng lựa chọn hình thức giải trí tương thích với niềm đam mê của chính mình. Mỗi trò chơi đều cho thấy sự tỉ mỉ, tâm huyết của thương hiệu VF555.

Thương hiệu sở hữu giấy phép hoạt động được bởi tổ chức quản lý cá cược và chính phủ nước sở tại, đảm bảo tính pháp lý hoàn toàn minh bạch. Điều này giúp các đối tác sẵn sàng đồng hành lâu dài và thành viên yên tâm đầu tư vốn cược để săn thưởng. Những tình trạng liên quan đến bảo mật hay điều khoản đều liệt kê rõ ràng trên trang.

Về cơ bản, giao diện VF555 được thiết kế theo tiêu chuẩn chuyên nghiệp của châu Âu, vì vậy các tính năng đều rất dễ sử dụng và tương thích trên cả website lẫn app. Người chơi được phép truy cập và tham gia cá cược mọi lúc, mọi nơi mượt mà, tuyệt đối không xuất hiện tình trạng gián đoạn giữa chừng. Bạn có thể tải ứng dụng trên iOS hoặc Android tại VF555 tùy thích.

Hệ thống hỗ trợ rất nhiều phương thức thanh toán tiện lợi dành cho các hội viên chinh chiến như là chuyển khoản ngân hàng, ví điện tử và thẻ cào. Điều này tạo điều kiện cho quá trình nạp hoặc rút diễn ra cực kỳ nhanh chóng. Cơ chế bảo mật hoạt động giao dịch cũng rất tiên tiến đảm bảo thông tin cá nhân và tài khoản của thành viên được giữ kín 100%.

VF555 thường xuyên triển khai rất nhiều sự kiện ưu đãi khủng dành cho thành viên trải nghiệm lâu năm và người mới. Trong đó bạn có thể tìm thấy phần thưởng chào mừng, hoàn tiền, quà tặng miễn phí trong các dịp đặc biệt,… với hạn mức lên đến hàng triệu, trăm triệu đồng.

Một trong những điểm giúp VF555 được đánh giá cao là đội ngũ hỗ trợ khách hàng luôn túc trực xuyên suốt 24/7, sẵn sàng giải đáp tất cả thắc mắc của khách hàng. Dù bạn đang thắc mắc về quy trình đăng ký, game cá cược hoặc sự kiện ưu đãi đều có thể liên lạc qua live chat, hotline, fanpage để nhận được sự trợ giúp trong tích tắc.

Hiện nay, VF555 có cung cấp chương trình đại lý nhận hoa hồng, giúp cho người dùng có thêm nguồn thu nhập thủ động cực kỳ tiện lợi. Quá trình tham gia rất đơn giản, chỉ cần chuẩn bị đầy đủ thiết bị, cập nhật thông tin chính chủ và giới thiệu người mới đăng ký tại nhà cái là có thể nhận ngay khoản tiền hậu hĩnh.

Để thu hút lượng lớn thành viên tham gia giải trí, VF555 đã thiết lập rất nhiều sản phẩm hot hit dưới đây:

Trò chơi nổ hũ là điểm chạm tuyệt vời giúp cộng đồng game thủ tại VF555 ngày càng lớn mạnh, bởi kết quả cho ra luôn minh bạch, công bằng và trúng thưởng cao. Slot VF555 thu hút người chơi bởi luật chơi đơn giản, đồ họa bắt mắt, hiệu ứng âm thanh sống động đem đến trải nghiệm phấn khích tột đỉnh.

Casino trực tuyến được xem là sản phẩm chủ lực tại VF555, đưa các thành viên đắm chìm vào cảm giác chân thực như đang trải nghiệm tại những sòng bạc xa hoa trên thế giới. Với bàn chơi đầy đủ tính năng, đồ họa tinh tế, nữ Dealer xinh đẹp, mỗi ván bài đều đem đến cảm xúc thú vị và kịch tính. Những tựa game đáng thử tại sảnh casino như là:

Thể thao ảo được thiết lập tại VF555 có tích hợp công nghệ 3D, mô phỏng từng khung hình vô cùng chân thực, độc đáo, nơi người chơi tự do đặt cược và nhận thưởng nhanh gọn. Game thể thao tại nhà cái cho thấy đồ họa sắc nét, âm thanh sống động không thua kém trận đấu ngoài đời, Những bộ môn phổ biến mà bạn có thể chinh chiến bao gồm:

VF555 gây ấn tượng với đông đảo lô thủ khi cung cấp nền tảng cược xổ số đủ mọi thể loại và có tỷ lệ trả thưởng cao top đầu thị trường, lên đến 1:99. Các dân chơi tha hồ nhận thưởng hấp dẫn và có đầy đủ thông tin để soi cầu miễn phí, qua đó giúp tăng xác suất trúng thưởng. Cụ thể những hình thức nên đầu tư tiền cược như sau:

VF555 phát trực tiếp những trận siêu kinh điển giữa các chiến kê dũng mãnh như gà tre, gà nòi, gà Mỹ,… tại các đấu trường danh tiếng gồm Thomo (Campuchia), Thái Lan. Điều này giúp kê thủ theo dõi và đặt cược một cách chân thực, đồng thời được chiêm ngưỡng từng cú đá độc đáo đến từ các chú gà chiến.

Hiện đại, độc đáo và tiện lợi là những tính từ mô tả về hình thức cược E-sport mà VF555 đã thiết lập để chiêu đãi khách hàng. Chuyên mục này được săn đón rộng rãi bởi những tín đồ đam mê thể thao điện tử. Mỗi giải đấu đều cho thấy sự đầu tư công phu với đồ họa đỉnh cao, mang đến những trải nghiệm mãn nhãn, bao gồm các game như là:

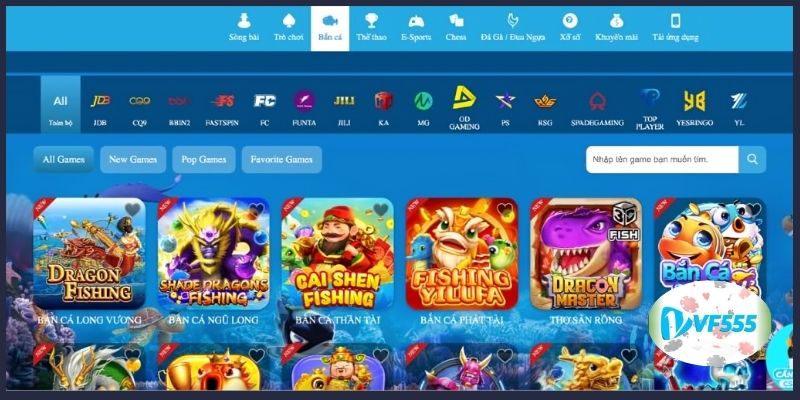

Nhắc đến sản phẩm chinh phục hàng triệu người chơi chắc chắn không thể bỏ qua bắn cá tại VF555. Mỗi tựa game đều mang bản sắc riêng biệt, có thiết kế đồ họa sắc nét, âm thanh chân thực và lối chơi cực kỳ lôi cuốn. Hội viên được quyền chọn mức độ khó khác nhau, sử dụng vũ khí hiện đại và những tính năng sẵn có để săn cá, từ đó nhận về khoản thưởng cực kỳ giá trị.

Để rinh về khoản thưởng kếch xù từ game cá cược tại VF555, hãy làm theo hướng dẫn chi tiết dưới đây để có trải nghiệm mượt mà nhất. Cụ thể:

Để có trải nghiệm cá cược an toàn và hiệu quả tại VF555, bạn cần lưu ý những điều quan trọng ngay bên dưới:

Qua nội dung trên, chắc hẳn các bạn đã hiểu rõ hơn về thương hiệu VF555 đang nổi đình đám hiện nay. Hãy nỗ lực chinh chiến hết mình để đạt được thành tựu vang danh và nhận thưởng khủng nhé!